Push Notification Engine

Active notification of incoming instant payments in real-time is currently a basic requirement for companies, as this can be used to immediately initiate further processes.

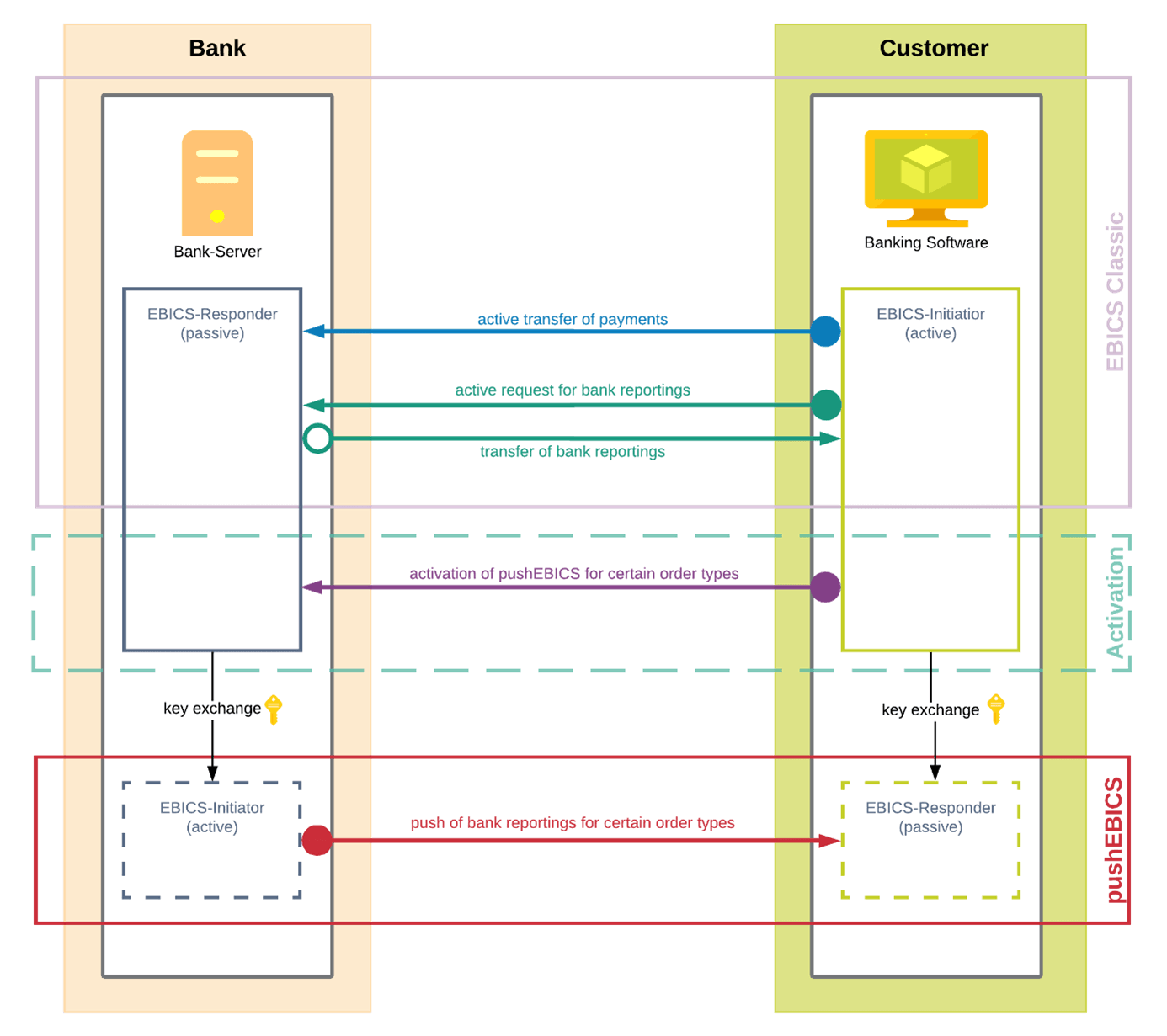

Most banks’ interfaces, e.g. communication via EBICS or the use of open banking PSD2-APIs, are based on companies actively requesting information (pull method). Even if there is an extended specification for the use of EBICS for real-time notification, it remains a pull method approach, as an EBICS request must still be initiated after a notification via WebSocket.

As the customer does not even know if data is available in some cases, e.g. with a credit notification from the receipt of an instant payment, it makes sense to proactively inform corporate customers in particular when such an event occurs and to be able to have the bank actively initiate transmit this data.

Our Push Notification Engine actively transmits data to your corporate customers via a defined interface (push method). In addition to proprietary interfaces and REST APIs, Push EBICS can be used for secure transmission.

Push EBICS

However, as soon as user data needs to be transmitted to corporate customers, regardless of the type of API, the customer raises questions about security measures such as transport encryption, user data encryption and sender authentication.

So what could be more obvious than to use the EBICS protocol for this type of communication, too. The EBICS protocol is also an API in the broader sense, even if it is not as “lightweight” as a RESTful API because security and key management play a significant role.

In an established, initialised EBICS connection between the company and bank, all the necessary keys are already available, exchanged and verified. The roles are simply swapped to allow for communication between the bank and the company. The only thing that changes is the initiating party: Where previously the corporate customer had to request data, in the future this can be actively provided by the bank via EBICS.

Push EBICS is activated by simply sending off a signed EBICS order in which the company informs the bank at which URL it can be reached for receiving EBICS messages and which order types should be actively delivered by the bank. It is of course also possible to deactivate individual types of orders or all types of orders.

“Push EBICS makes instant payments truly instant and enables 24/7 cash management”

ennoxx.banking as open corporate digital banking solution

With ennoxx.banking, we provide you with an open corporate digital banking solution that, in addition to its technical functionalities, is particularly characterised by the following properties:

- A modern and device-independent UI

- Multi-client capable & secure

- Able to be integrated & automated

- Reporting & dashboards