Notifications

Daily work can be optimised significantly by automatically informing users about events without the need for manual user interaction.

An event-driven notification system can be helpful in the following cases:

- Rejection of a payment file from a bank

- Payment files requiring authorisation that have not yet been fully signed

- Account balances outside of the agreed credit limit due to intraday transactions

However, the option to regularly receive information at a certain time can be advantageous when handling the following tasks, for example:

- Daily morning overview of the cash holdings

- Weekly overview of accumulated account activity

Both event-driven and regular reports can be sent via e-mail or messenger service (Slack, Teams, etc.).

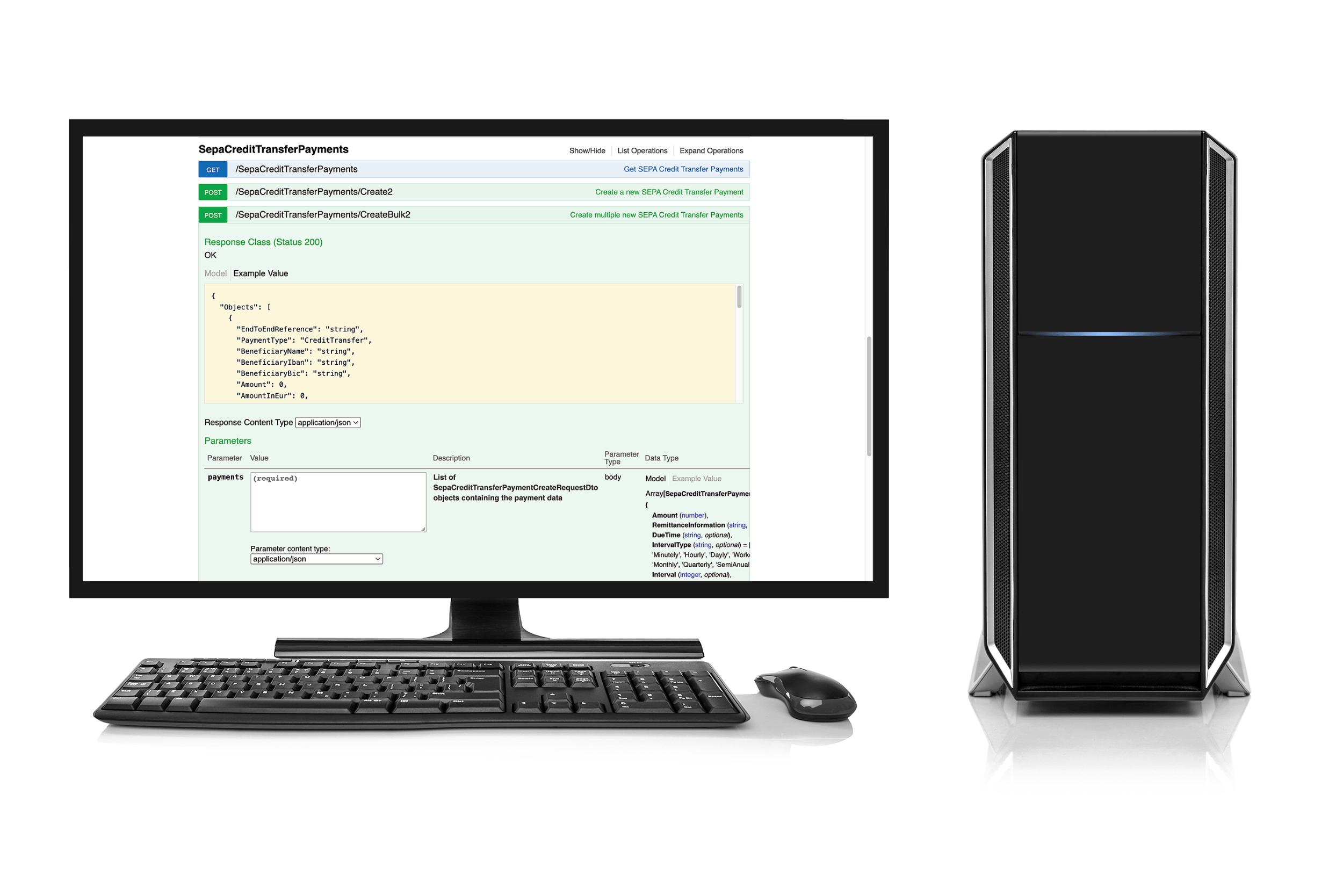

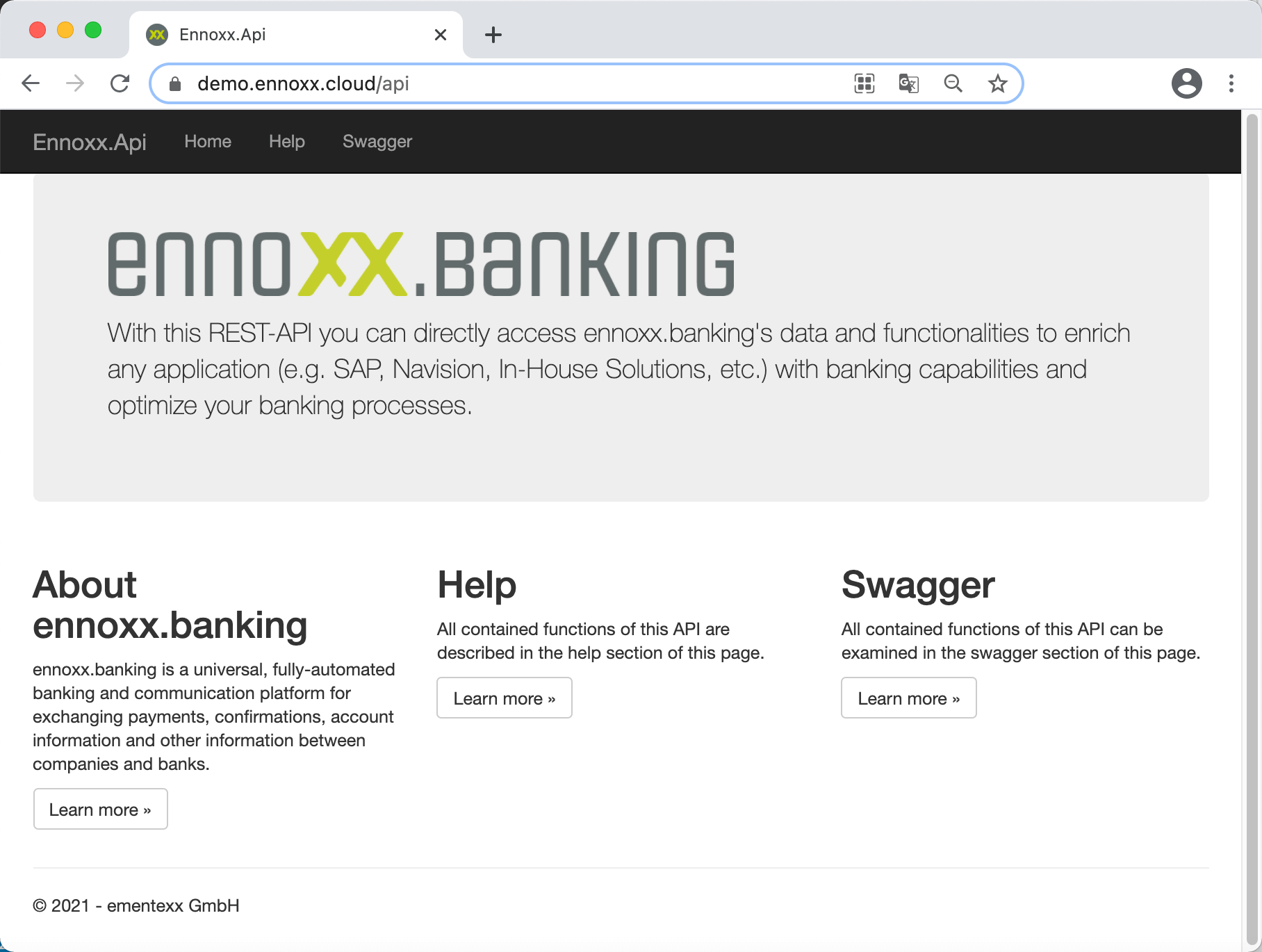

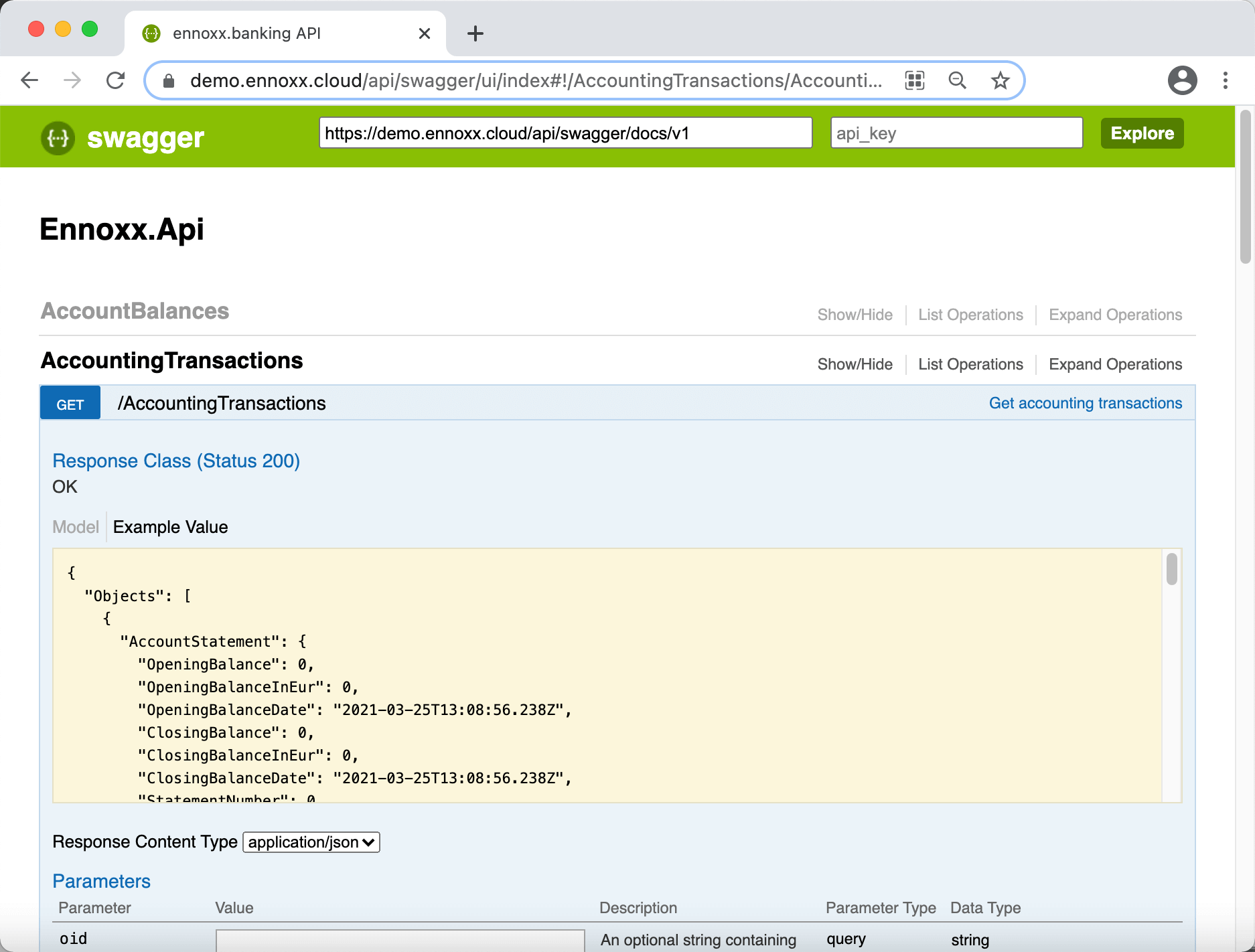

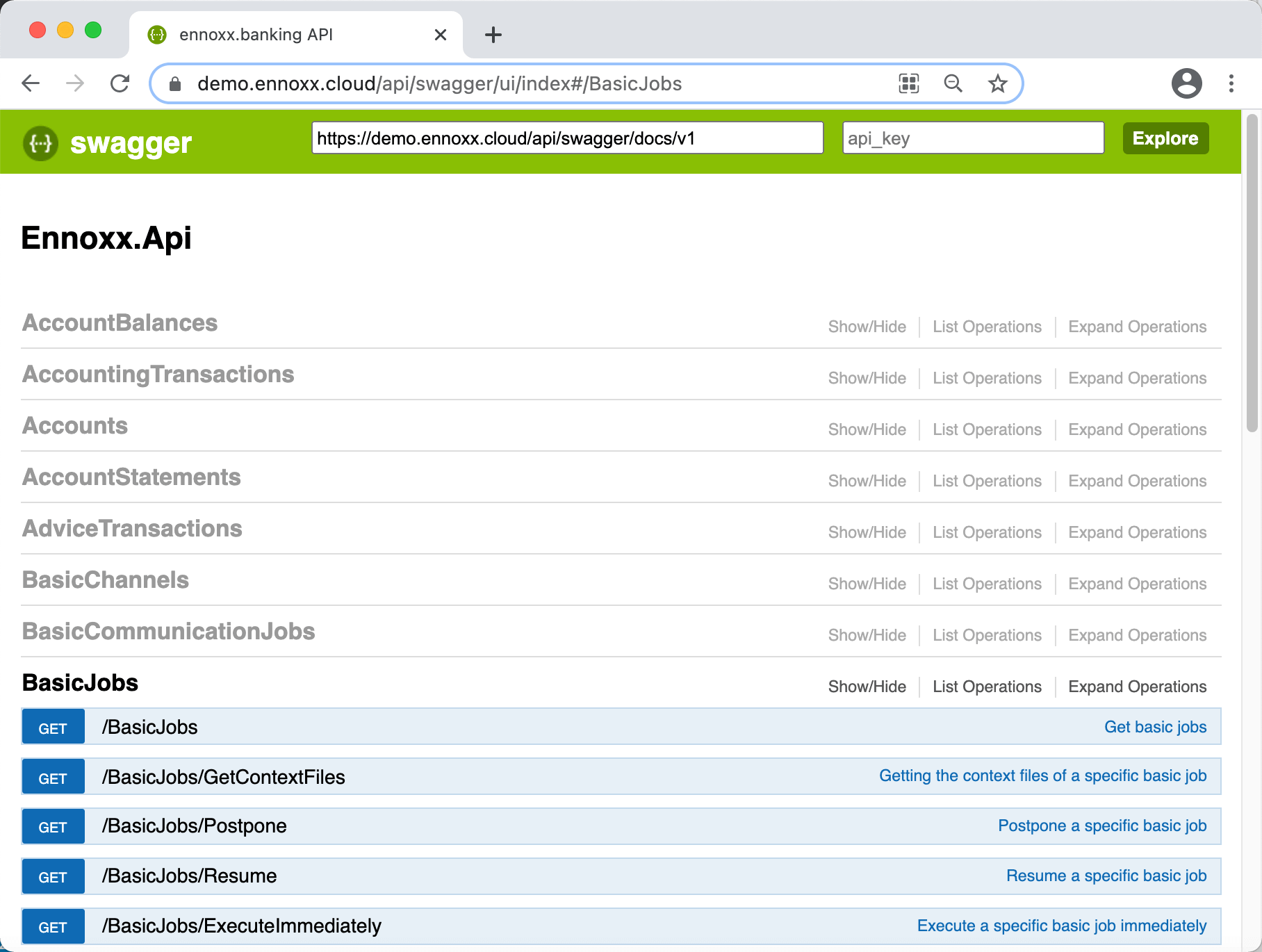

Banking APIs

We provide a banking REST API for the direct connection of third-party systems.

This enables the complete integration of banking functionalities into other systems.

One of the most common use cases is the transfer of a payment file from an ERP system (SAP, AX, Navision, etc.) directly to ennoxx.banking. This direct transfer moves the payment file from the secured environment of the ERP system directly and without media disruption over to the secured environment of ennoxx.banking. This makes it much harder to attack this file because the process never creates a physical file (“fraud prevention”). Authorisation of the transferred payment file in ennoxx.banking can be triggered directly from the ERP system and the status of the execution can be monitored.

Conversely, information from the bank can of course also be called up directly from third-party systems. The following options are available:

- Original files from the bank

- Transformed files

- User data via JSON via REST API call

Absolute flexibility in the technology used by the third-party system is guaranteed by the REST APIs market standard. Our API relies on Swagger for documentation.

Enhanced connectivity

Comprehensive connectivity is required in order to ensure deep integration into existing infrastructures and processes. That is why, in addition to communication with banks, communication with other systems plays an important role for us.

The standard options for this communication are currently as follows:

- Directories

- FTP/SFTP/FTPS

- Message queues

- Cloud storage

- EBICS servers

- OData

For communication methods that by definition do not have any encryption, encryption (via AES, PGP, Zip, etc.) can still be used.

It does not take much effort to expand to include additional communication and encryption methods.

EBICS server functionality

We are the only banking solution to currently offer companies EBICS server functionality!

The use cases for this are as varied as they are process-optimising:

Payment-generating systems (such as ERP or HR systems) or those of external service providers can deliver payment files direct to ennoxx.banking via EBICS instead of sending them to the bank. This means that you can avoid the unpopular VEU (distributed electronic signature) and establish standardised processes for processing all payment files.

Third-party systems that currently collect account information from banks via EBICS can collect and process this centrally via ennoxx.banking. This can significantly reduce the costs and administrative effort involved in the creation and usage of EBICS access at banks.

As EBICS is a secure, well-known and reliable communication method, it can also be used for in-house data exchange and the authorisation of orders. In the case of a payment factory, for example, branches can approve their payments via headquarters, which then takes over final implementation.

Particularly in the context of incoming instant payments, it is very important not only that companies can actively bring up the bank’s interfaces, but also that banks can actively reach their corporate customers, for example, in order to inform them in real-time of incoming instant payments. In this regard, EBICS is the ideal standard communication method between companies and banks.

find out more about push EBICSOData – Linking with Excel

With OData, we support a standard that makes it possible to read out all data from ennoxx.banking on a wide variety of different applications.

This makes it possible, for example, to link account balances, transactions and interim transactions with an Excel table. This data can be updated at any time without the need for a CSV export from ennoxx.banking and import into Excel.

With the current data linked in this way, existing functionalities and formulas can of course be used in Excel and calculations can be carried out.

Transformations

In many cases it can make sense to transform files into another format in order to add further data or to convert an outdated format into a current one.

Common transformations are as follows:

- Creation of an EXTRACT.TXT/SALES.TXT or a tailored format from collected account information

- Creation of payment files based on an Excel template, CSV, JSON, etc.

- Harmonisation and consolidation of account information

- Splitting account information by account

- Conversion of legacy formats into current formats

If you require a certain format for further processing or want to deliver from your systems for payment generation, we would be happy to do this for you.

Extension options

The range of functions of our Connectivity and data transformation solution can be extended at any time to include the following modules:

![]()

ementexx did what they promised to do: They implemented a central banking system for us in a very short period of time and connected it to our existing systems. The optimised workflow accelerated our processes and reduced our costs.

Stefan Kreiling

Vice President Payment

Kreditech Holding SSL GmbH

Digital banking platform ennoxx.banking

This solution package is based on our ennoxx.banking digital banking platform, which, in addition to its technical functionalities, is particularly characterised by the following properties:

- A modern and device-independent UI

- Multi-client capable & secure

- Able to be integrated & automated

- Reporting & dashboards

find out more about ennoxx.banking