What is ennoxx.banking?

With ennoxx.banking, we provide you with an open corporate digital banking solution that, in addition to its technical functionalities, is particularly characterised by the following points:

Our web-based, responsive UI can be used on almost any device, regardless of the operating system. Intuitive use and data processing is joined by simple selecting, sorting, filtering, grouping and exporting.

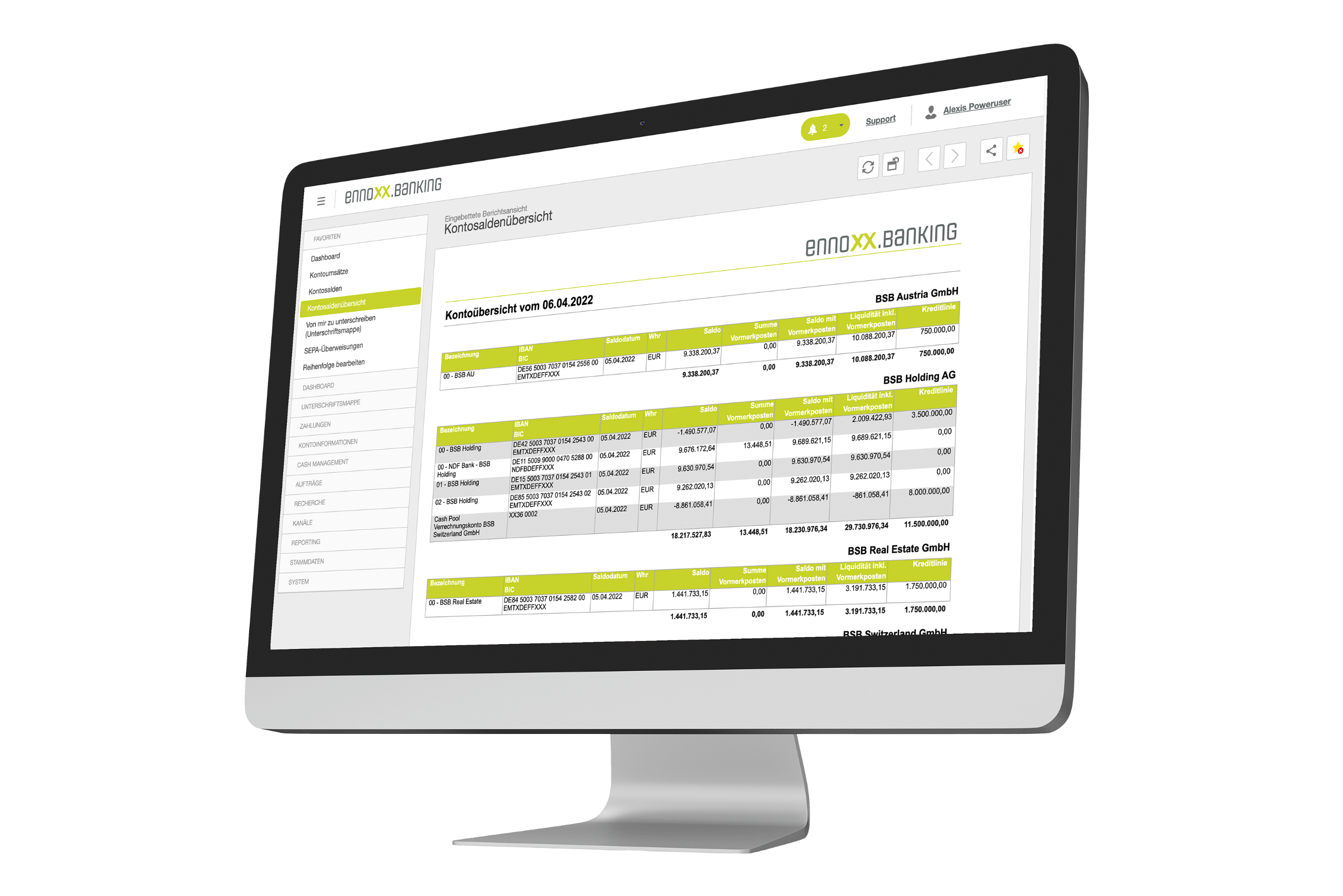

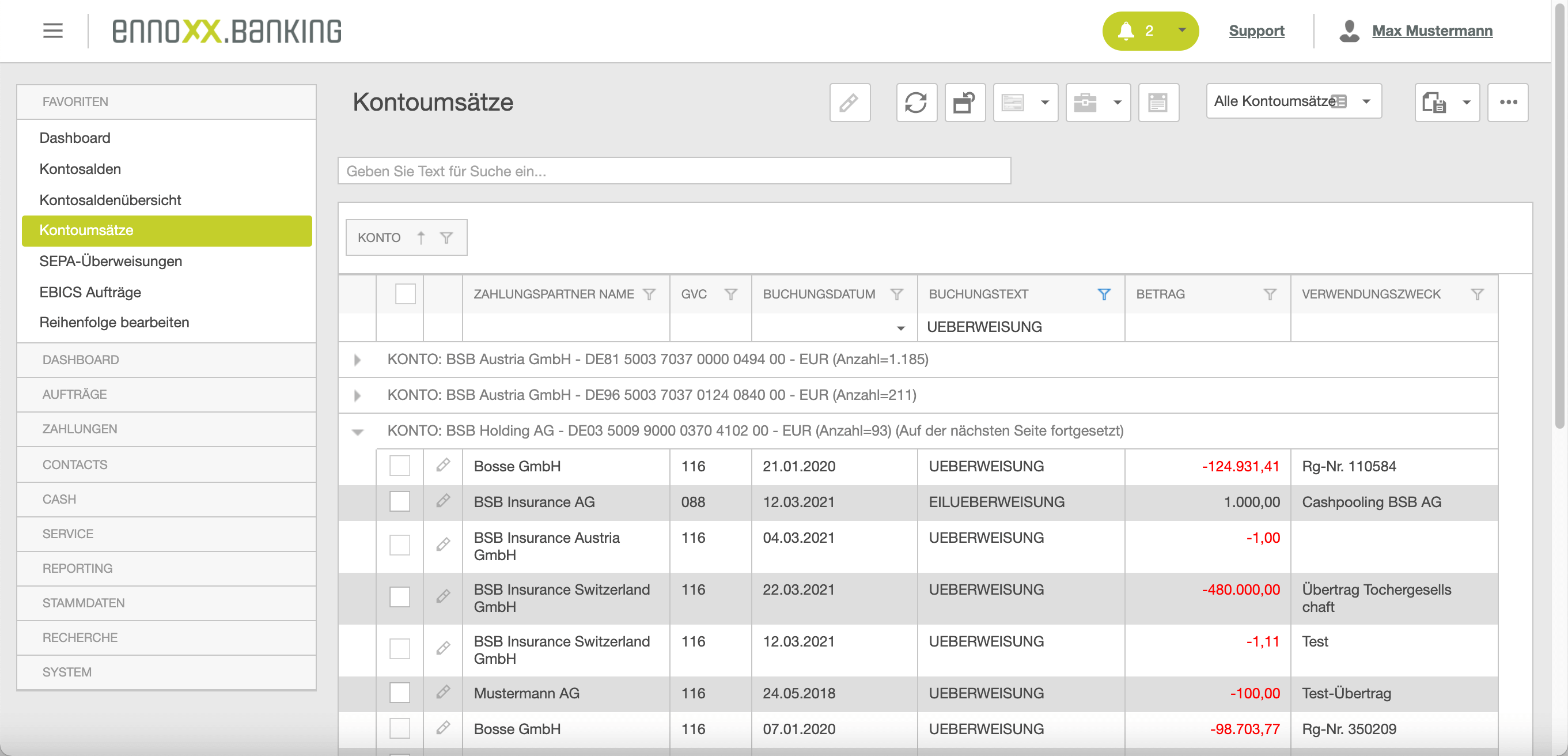

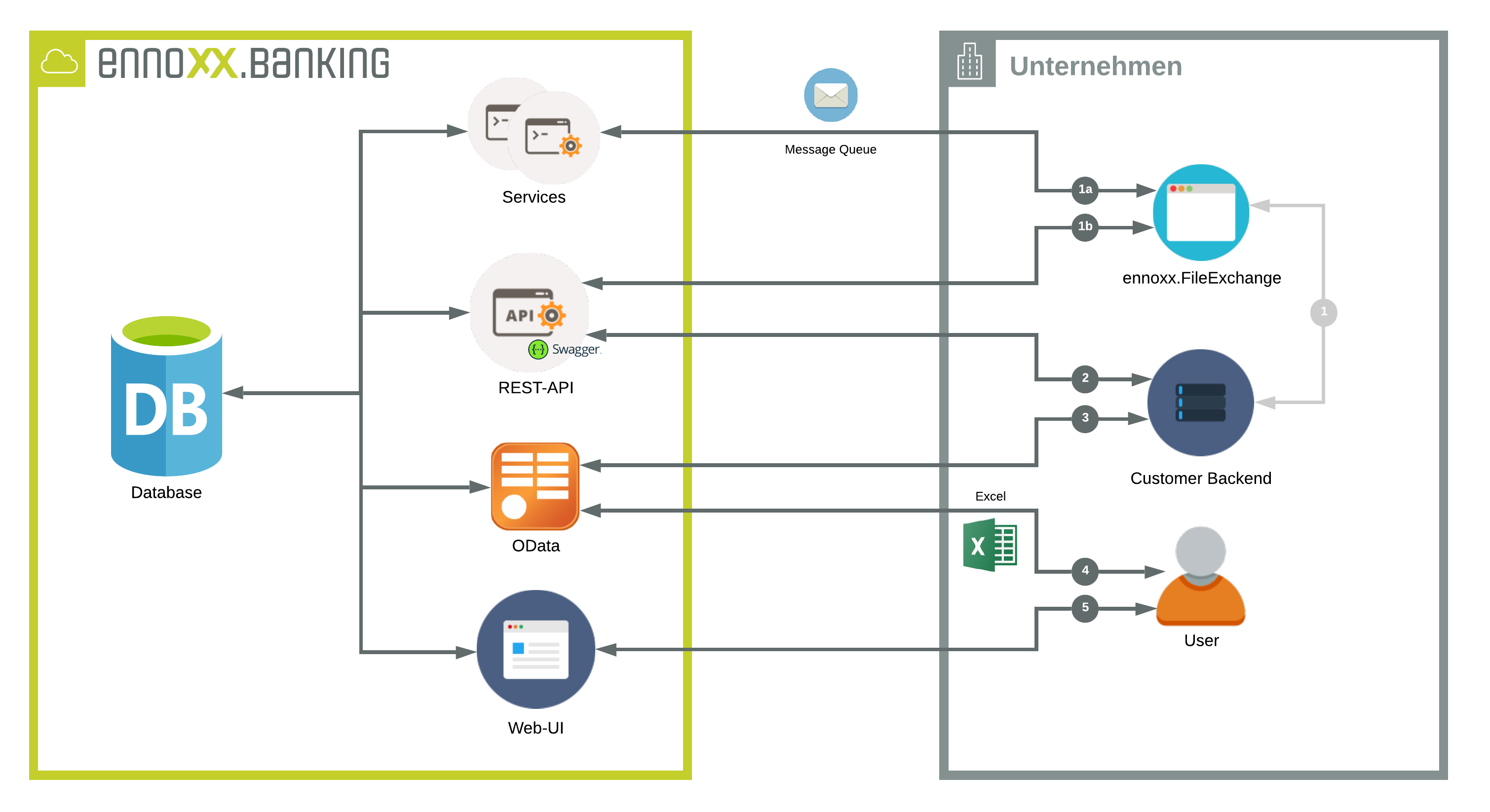

The structure of the application is as follows:

On the left is a navigation menu that also allows for the compiling of user-specific favourite entries. On the right, data can be displayed in the following variants, depending on the data type:

- Lists

- Details

- Pivot tables

- Dashboards

- Reports

These views offer the following options:

- Search

- Filter

- Sort

- Group

- Export (CSV, Excel, etc.)

- Customise (including columns and their order)

A detailed view can be accessed from the list view. In the upper section of the application there are possible functions that can be applied to the selected data records.

The multi-client capability combined with a comprehensive role and security concept allows finely-grained authorisation granting for companies, accounts, access classes, etc. down to the field level.

Multi-client capability

The implemented multi-client capability enables the management of several companies. This enables the consolidation of several banking solutions into one central solution.

Evaluations and processes can be carried out on a client-specific and cross-client basis. This means that a branch user only has access to their own branch, while an employee at headquarters has an overview of all the companies.

Authorisation concept

Comprehensive user, role and authorisation administration based on companies, departments, and access classes down to the field level.

For example, in the case of staff payments, authorisation can be permitted so that some employees can only see the sum of the payment file, while others can also see the details.

Logging on and signatures

A password policy can be defined for logging into the system and also the way in which a user can log in.

Two-factor authentication (2FA) can also be used to secure logging in to the application and when providing an electronic signature.

Multiple assessor principle

There is the option to administer security-relevant data such as users, roles and access authorisations using the multiple assessor principle. This means that new systems and changes only come into effect after approval by at least one other person. In addition, all processes are logged and archived to ensure traceability at all times.

Automation is an essential part of our platform. In addition to time-controlled processes, it is also possible to define event-controlled overflows.

For example, account information can be obtained from the bank at a defined time each working day, input in an event-controlled way (i.e. after successful collection) and then made available to the ERP system for processing.

Events can also be triggered when an error occurs: If the bank rejects a payment file, an automated response can be made, e.g. by the system notifying the user via e-mail or messenger service.

These options allow for customised process chains and post-processing techniques.

No banking solution should be an island: In order to automate the processes in your company in a way that makes the most sense, ennoxx.banking offers different interfaces to integrate seamlessly into the existing infrastructure and processes. This includes different types of connectivity and data transformation options through to your own banking API.

That is why we call our platform Open Corporate Digital Banking.

ennoxx.banking supports all formats used for processing payment transactions between companies and banks. These include SEPA formats, ISO20022, SWIFT-MT formats and national and proprietary formats.

In many cases it can make sense to transform files into another format in order to add further data or to convert an outdated format into a current one.

This opens up the possibility for applications to work with bank-specific formats without much hassle and without having to actively support them.

By using customisable dashboards and reports, all essential KPIs and data can be viewed at a glance. In addition, ennoxx.banking can be integrated into in-house business intelligence tools.

Here, too, you can benefit from the ability to automate by creating regular reports and having them sent via e-mail. For example, you can have the cash balance sent to you every morning or be informed about cash changes on a weekly basis.

The standard reports already included can be customised using the integrated report designer and completely new, customised report templates can be created.

In addition to the output of reports, you can also integrate them directly into the navigation bar as dynamic evaluation, so you can access your preferred reports at any time and with the most up-to-date data.

As all of the data and information is stored centrally in a database and the system architecture does not impose any restrictions on the amount of data, data can remain in the system for as long as it makes sense or is required.

However, so that daily work is not complicated by outdated data, data can be moved to the research area (a type of data archive) after a specified period of time. In this research area, you have access to all current and archived data at any time via the UI.

ennoxx.banking is a cloud-based (SaaS) digital banking platform, but if necessary it can also be operated on-premises in your company’s infrastructure.

Our SaaS is a specially designed, dedicated instance with a separate database, services and UI. This ensures physical data separation from other customers (“Chinese wall”). As our SaaS solution and on-premises software do not differ from one another, you have the advantage of being able to migrate to the other solution in the future without issue.

The hosting of ennoxx.banking is of course GDPR-compliant in a European data centre. We use Microsoft’s Azure platform for this.

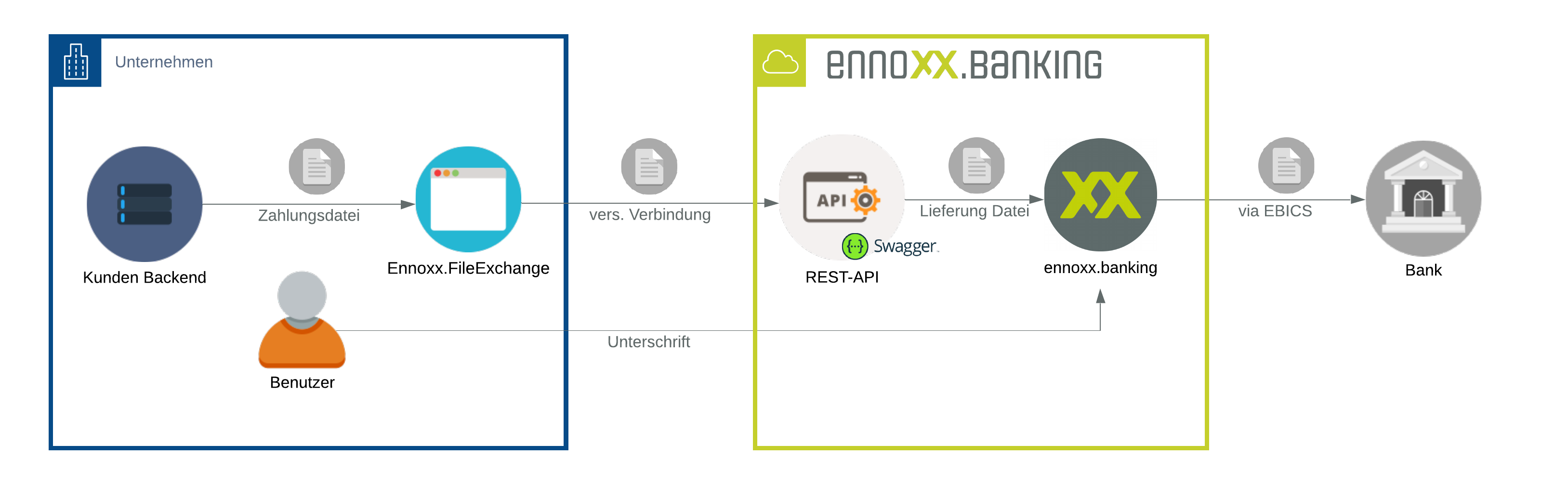

For the simple, secure and automatable option for transferring data between your infrastructure and our SaaS solution, we offer the ennoxx.FileExchange.

Despite the enormous range of ennoxx.banking functions, customers may have requirements that go beyond our standard offer. This can be with regards to functionality, connectivity to a specific system or a proprietary data format.

Here, too, we can easily remedy the situation: Thanks to the modular architecture of ennoxx.banking, it is easy to implement expansions. The features you need are developed by us and provided via our platform.

ennoxx.banking is compatible with