Cash Visibility

A basic prerequisite for successful cash management is the visibility and validity of the holdings. This should be guaranteed at all times through the automated collection and reading of account information.

It is also necessary to be able to assess the information obtained in a simple and versatile way. This is why we offer you the following options:

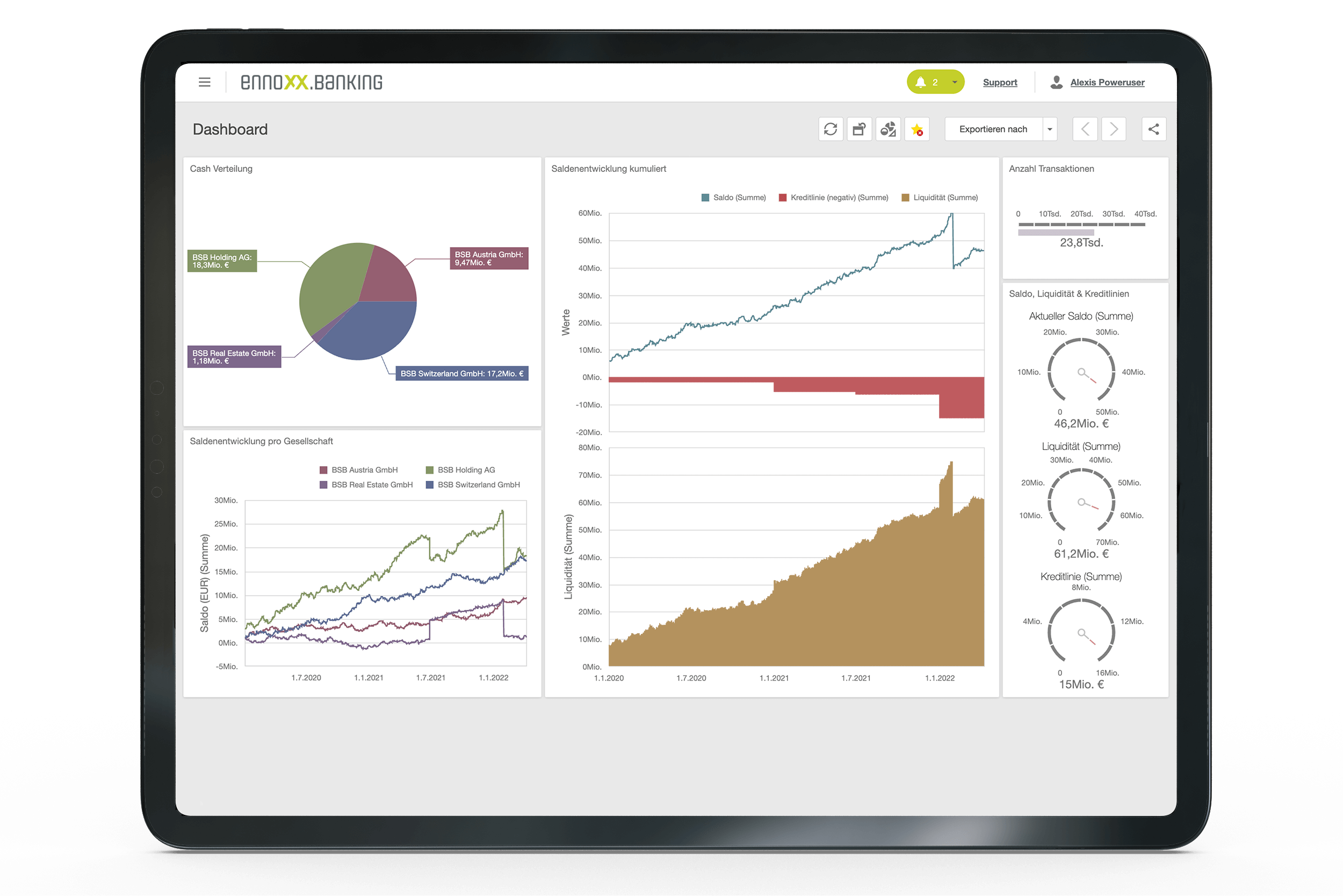

- Graphic representation of the essential KPIs on a dashboard

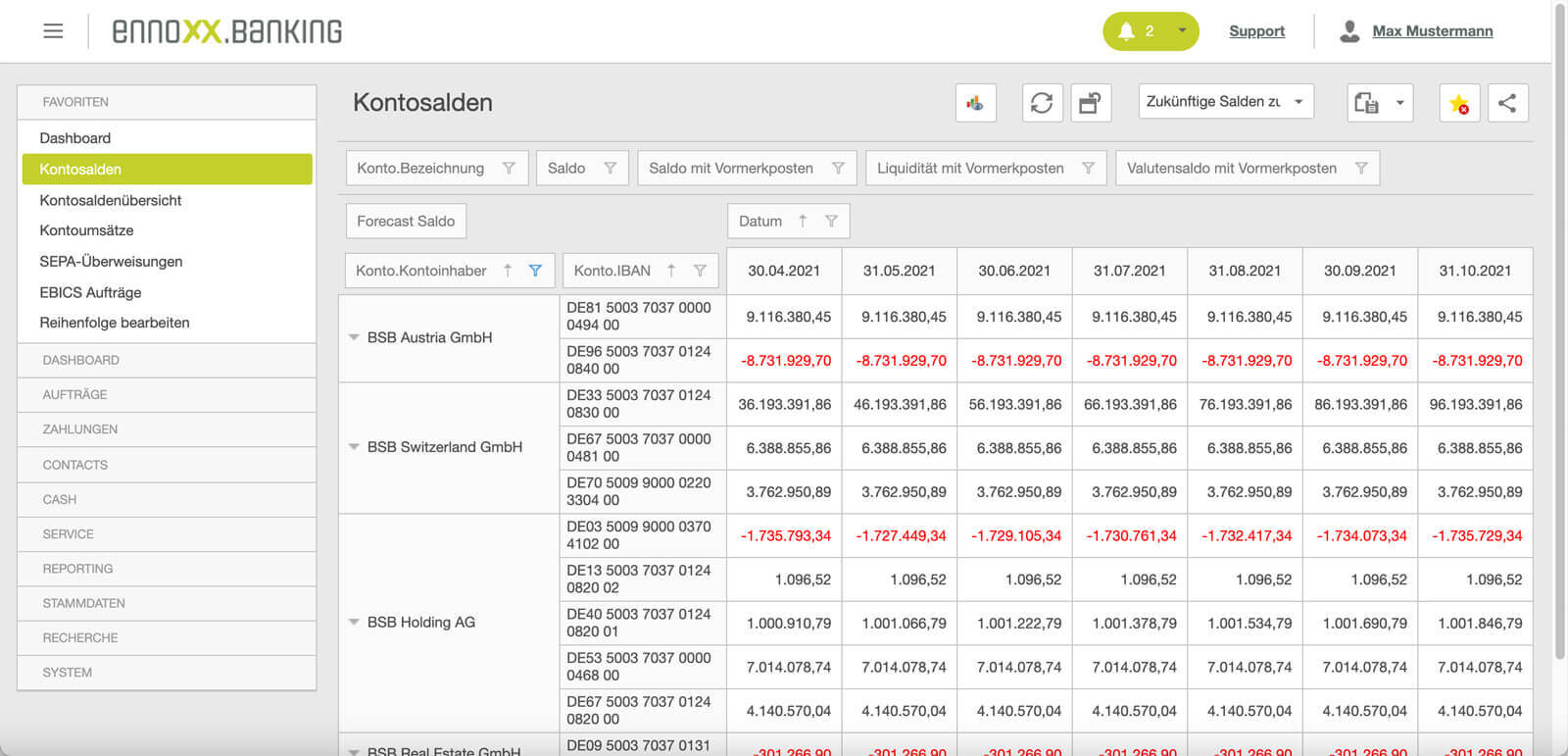

- (Currency) account balance lists

- (Currency) account balance histories

- Pivot tables for grouping cash holdings

- Standardised and customisable reports

Multi-currency requirements are, of course, also met and we support conversion to a base currency.

Cash Forecasting

All data that could lead to account activity in the future can also be used for liquidity planning. Recorded one-off and recurring payments lead to a cash forecast as much as payment files transmitted from external systems or those already transferred to the bank. Transfers between managed accounts also lead to an offsetting item on the target account.

In addition, manual cash forecasting (also one-off or recurring) can be recorded or read from other systems.

This means you have access to all the tools you need for comprehensive short, medium or long-term cash forecasting. The following data is made available for evaluation:

- Individual cash forecast transactions and their origins

- Pivot tables for grouping cash forecast transactions (time, accumulated sums, properties, origins, etc.)

- Account balance forecasting

- Liquidity forecasting

Automatic comparison of open cash forecasts with received account turnover is, of course, also possible.

Cash pooling & interest optimisation

In addition to the optimisation of debit balances, companies are now also focusing on the distribution of credit to avoid negative interest rates. As a result, the cash pooling offered by banks also plays a key role. However, these offers are generally restricted to individual banks or groups of institutions.

With our disposition methods, we also enable interbank cash pooling. This means that a corresponding disposition proposal can be created and executed according to the company’s requirements based on current balances including the intraday interim transactions. Here, too, there is the option to partially or fully automate this process.

We currently support the following disposition methods:

- Main/satellite account

- Reduction of debit balances

- Liquidity and/or credit distribution

Other individual disposition methods can be added at any time.

Extension options

The range of functions of our Cash & Liquidity Management solution can be extended at any time to include the following modules:

Due to the use procedure of one of our banking products, we decided to switch to a central solution in the future. In addition to covering the technical requirements and supporting our processes, ennoxx.banking also fulfils our wish to remain bank-independent and have customisable expandability.

Matthias Beinhorn

Head of Accounting bei

Galeria Kaufhof GmbH

Digital banking platform ennoxx.banking

This solution package is also based on our ennoxx.banking digital banking platform, which, in addition to its technical functionalities, is particularly characterised by the following properties:

- A modern and device-independent UI

- Multi-client capable & secure

- Able to be integrated & automated

- Reporting & dashboards