Bank communication

The topic of “communication security” plays a vital role in corporate digital banking. Things such as banking standards like the EBICS (Electronic Banking Internet Communication Standard) are used to ensure that national and international online payment transactions can be processed quickly, flexibly and with the highest level of security. This ensures secure communication between companies and banks.

In addition to EBICS, our solution also offers the following options for bank communication via SWIFT, XS2A and HBCI/FinTS.

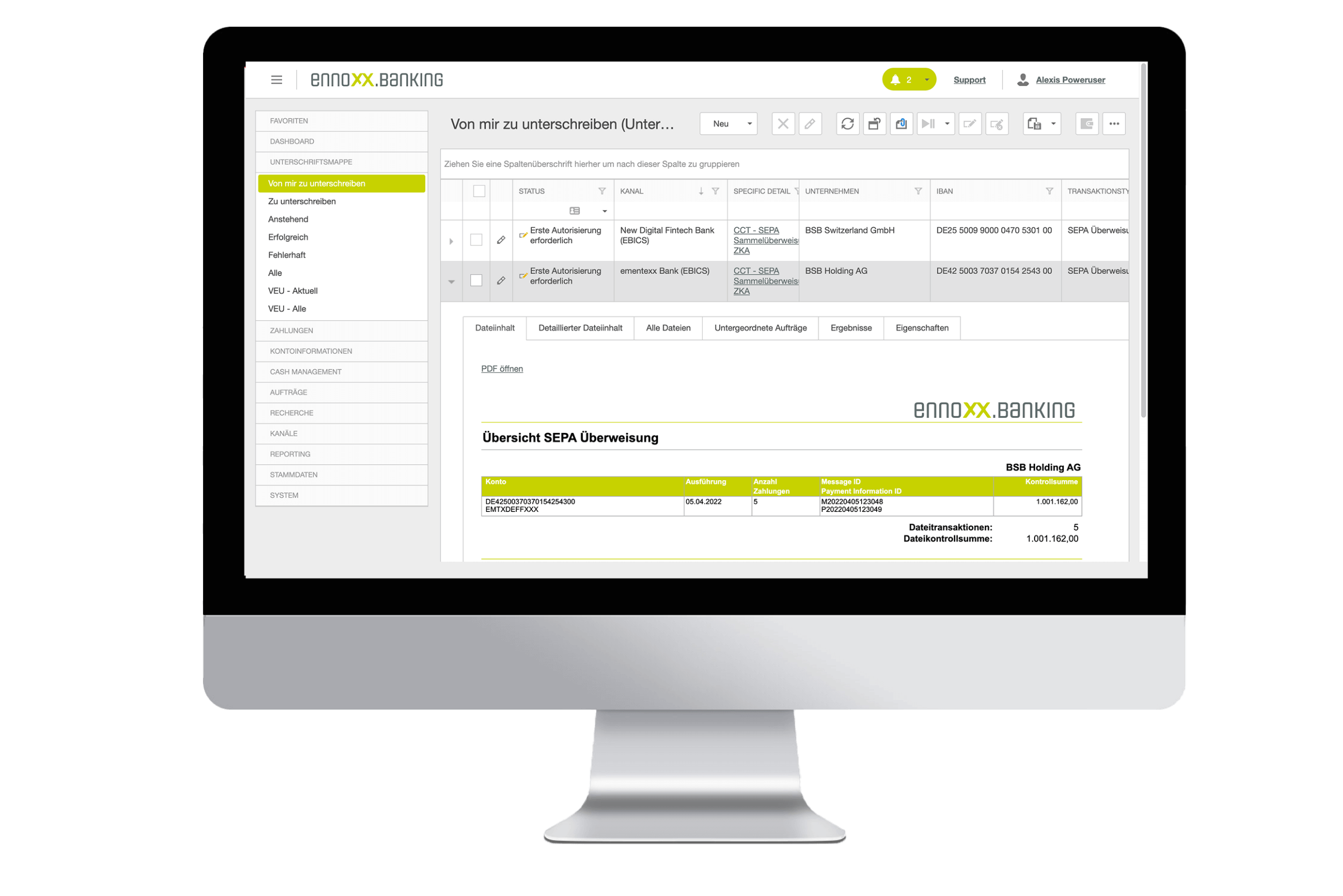

To increase security, signature authorisations can be supplemented with group and file limits beyond the familiar first, second and single signatory authorities. For example, this would mean no payments reach the bank unless the specific user group has authorisation.

Optionally, an upstream, internal authorisation facility can be used in order to be able to automate releases to the bank and therefore be able to do this with a smaller group of EBICS participants - a type of “corporate seal”.

The open, modular and expandable architecture of our Corporate Banking & Payments solution also allows a bilateral connection agreed with the bank. Please do not hesitate to contact us.

Transfers, direct debits and mandates

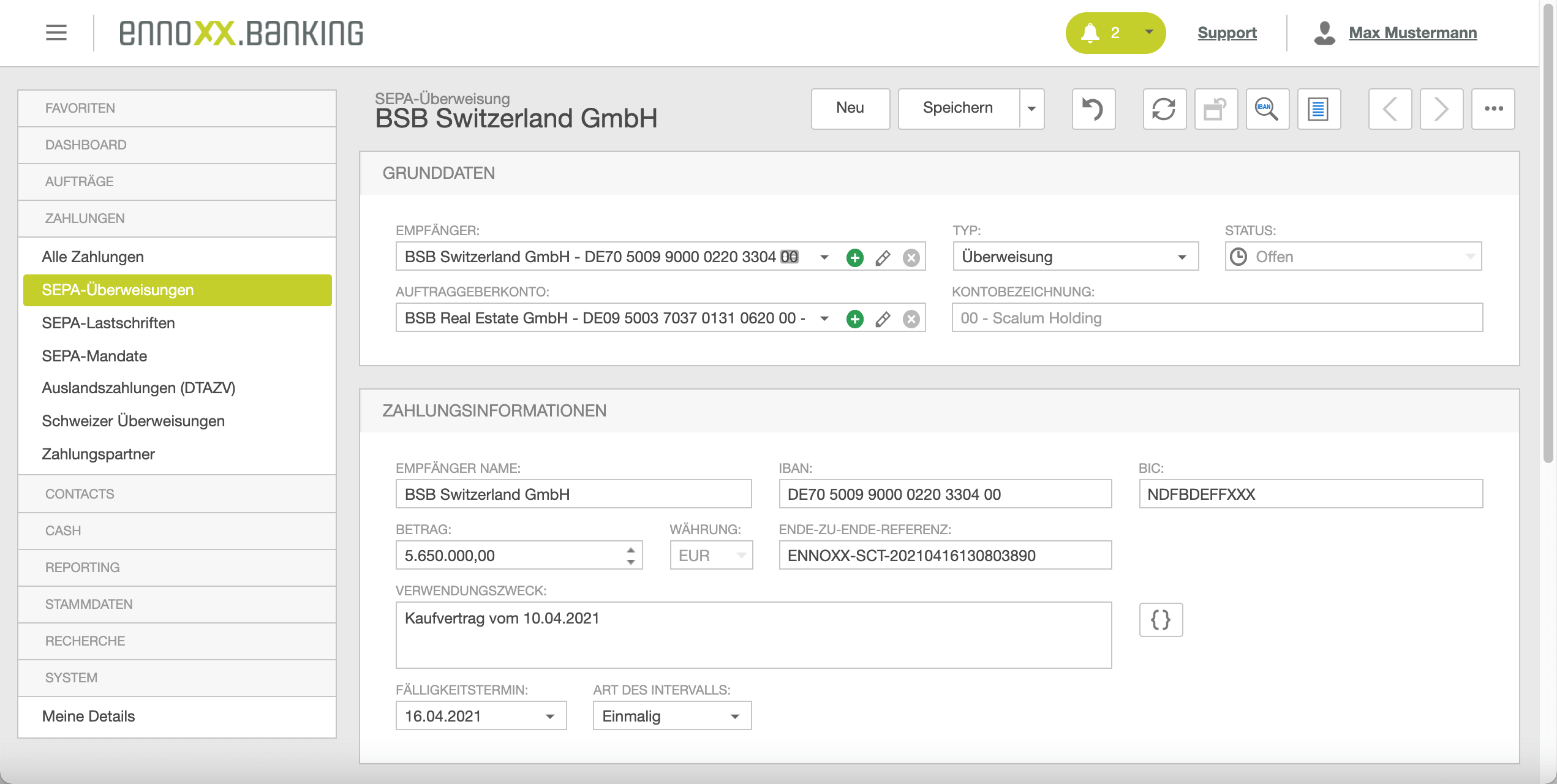

The recording, management and execution of payments can be carried out direct from the app for both one-off and recurring payments.

The following payment methods are currently supported:

- SEPA transfers

- SEPA real-time transfers (instant payments)

- SEPA direct debits (CORE/COR1 direct debits, B2B company direct debits, mandate administration)

- Foreign payments (DTAZV)

- Swiss payments (ESR/BESR, QR, ES, bank payment, salaries, foreign currency, SEPA transfers, foreign payments, cheques)

- International payments (MT101)

In addition, payment files can be imported from external systems (ERP, HR, etc.) and transmitted to the bank. In addition to the formats mentioned, these can also include any form of ISO20022. This forms the basis for setting up a company- and/or corporation-wide payment factory or in-house bank.

Authorisations for sensitive payroll payments can be restricted to meet your compliance regulations.

We can convert data in non-standardised or internal formats into a payment format that can be processed by the bank using the following solution extension.

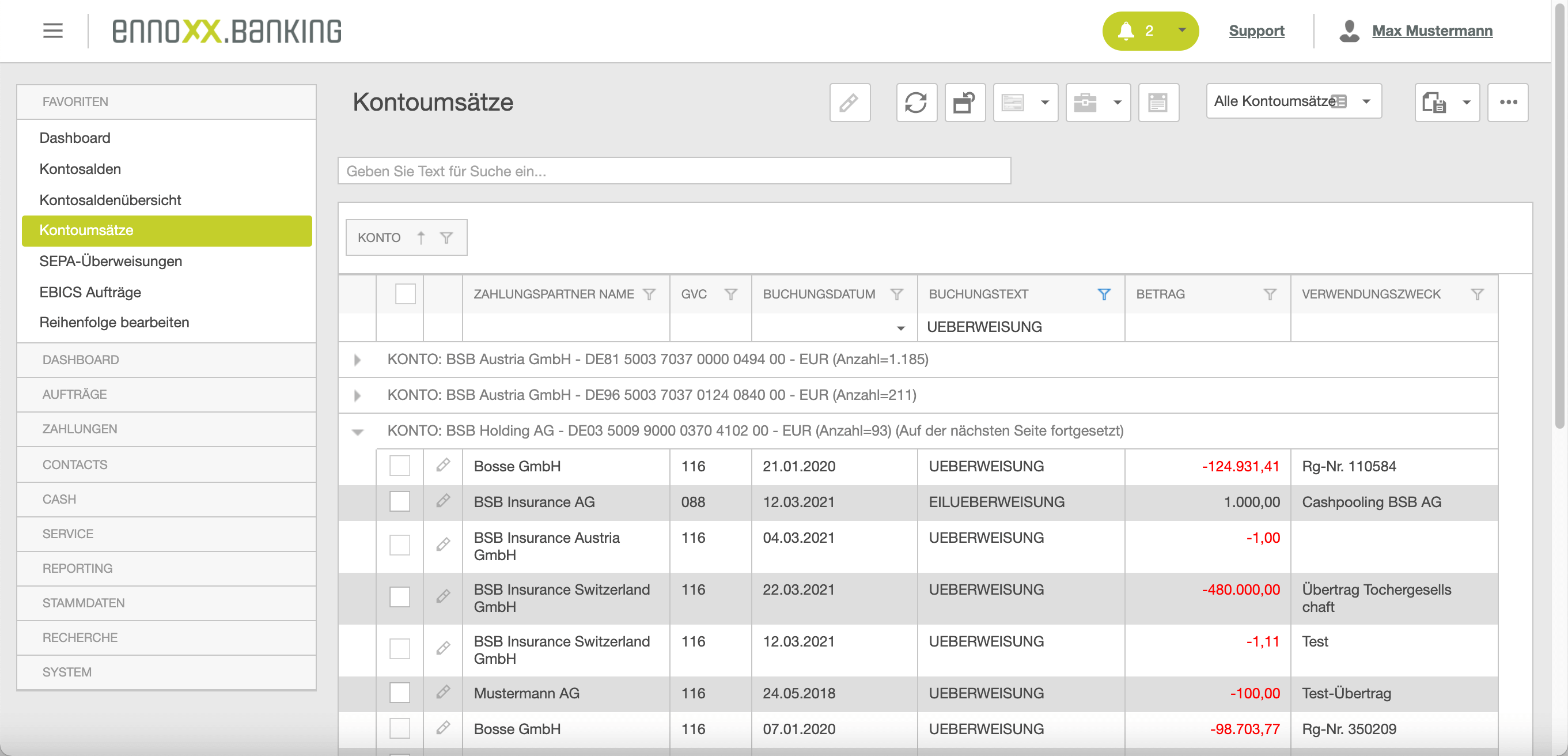

Account information and interim transactions

The collection of account information can be automated to such an extent that the user need no longer take any action. For example, daily statement information can be retrieved shortly before work starts and interim transactions can be called up automatically in the background every 15 minutes during working hours.

This account information retrieved from the bank is input directly and is immediately available to the user for inspection and evaluation. Thanks to the automated retrieval of interim transactions, the intraday account balance is also always up-to-date, which significantly simplifies and optimises scheduling.

Supported account information formats:

SWIFT-based

- MT940

- MT942

ISO20022-based

- camt.052

- camt.053

- camt.054

- pain.002

For better assignment and evaluation, it is possible to categorise individual bookings either automatically or manually.

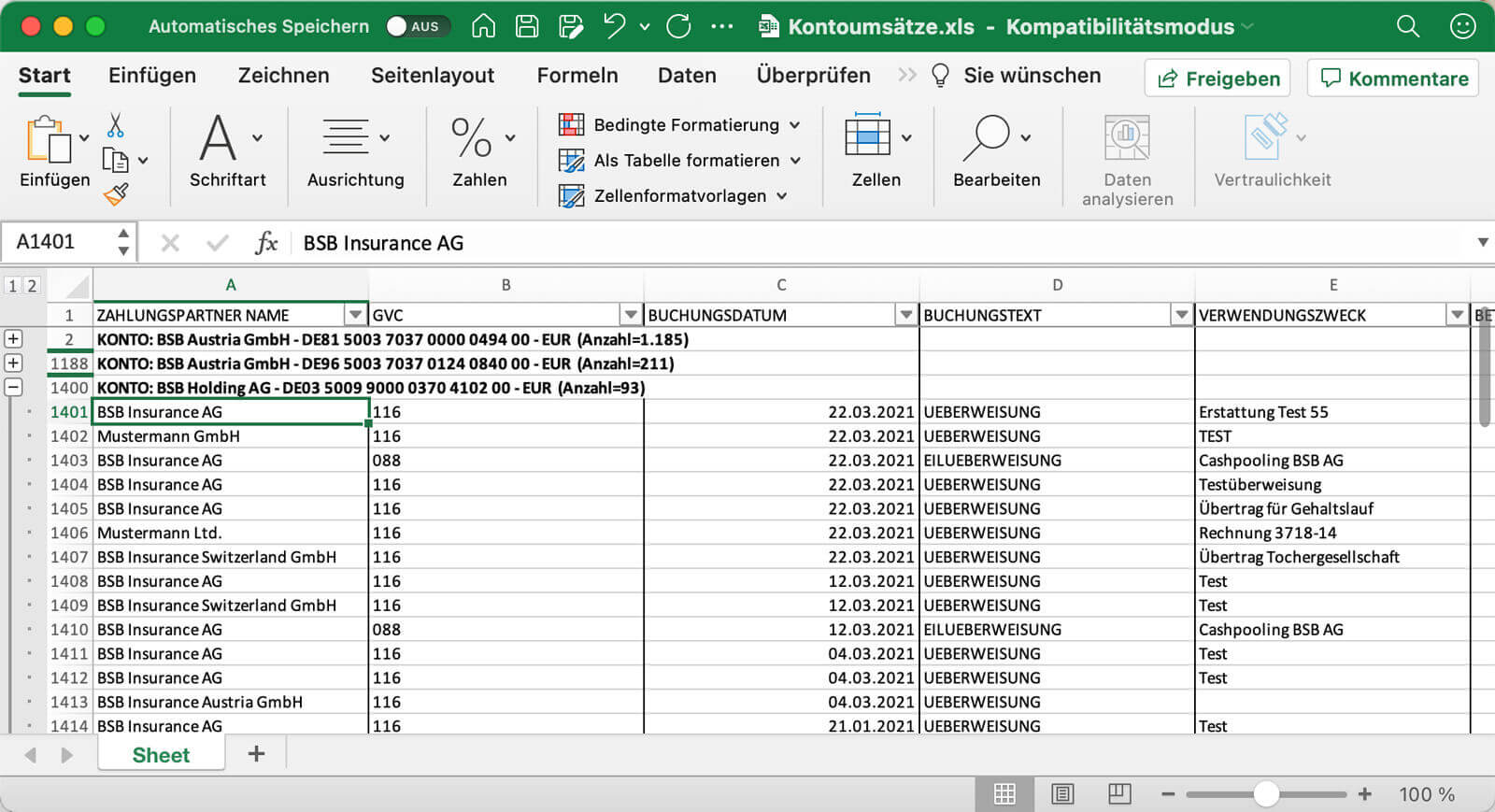

The imported data can either be exported on an ad hoc basis or issued in reports. Common formats such as Excel, CSV, PDF, etc. are available. Reports can also be generated automatically.

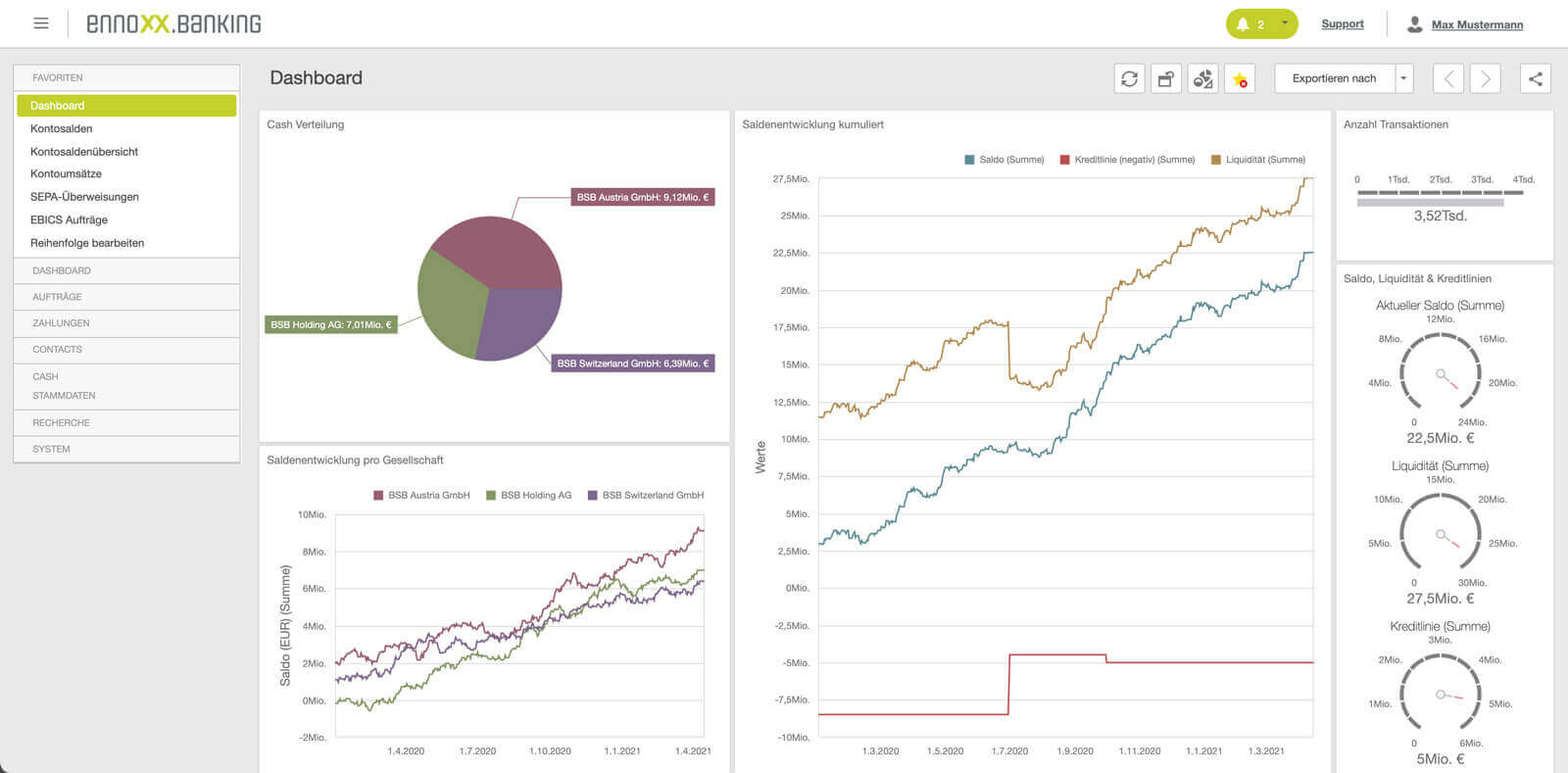

All information can be displayed on a dashboard to monitor individual KPIs.

We provide extended options for cash management and liquidity planning with further solutions.

Extension options

The range of functions of our Corporate Banking & Payments solution can be extended at any time to include the following modules:

We replaced the previously used MultiCash 4.0 with the cloud version of ennoxx.banking: This provided us with a stable, efficient banking solution that is tailored to our needs. Thanks to ementexx’s many years of experience in the implementation and migration of banking solutions, both the full implementation and training of our employees was able to be done remotely and contactless in line with coronavirus regulations.

Alexander Frede

Bereichsleiter Finanzen

Sprint Sanierung GmbH

ennoxx.banking as open corporate digital banking solution

With ennoxx.banking, we provide you with an open corporate digital banking solution that, in addition to its technical functionalities, is particularly characterised by the following points:

- A modern and device-independent UI

- Multi-client capable & secure

- Able to be integrated & automated

- Reporting & dashboards